Why Sports Is Becoming a Core Alternative Asset Class

The information herein is not complete and is subject to change. We may not sell securities of the Champion Fund until the Fund's registration statement filed with the Securities and Exchange Commission is effective. This website is not an offer to sell these securities and is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

For decades, ownership in sports was considered a luxury—more about fandom and prestige than portfolio construction. Franchises were acquired by billionaires and dynasties, often without the framework or discipline of traditional asset management.

That’s no longer the case.

Today, the global sports economy is emerging as a credible and compelling alternative asset class, one that offers allocators a rare combination of long-duration growth, cultural relevance, and structural resilience.

A Trillion-Dollar Global Ecosystem—Now Investable

The global sports industry is now valued at over $3 trillion. That figure reflects not just headline-grabbing team sales but also the full economic stack: media rights, technology platforms, hospitality, real estate, health and performance infrastructure, and IP-driven media.

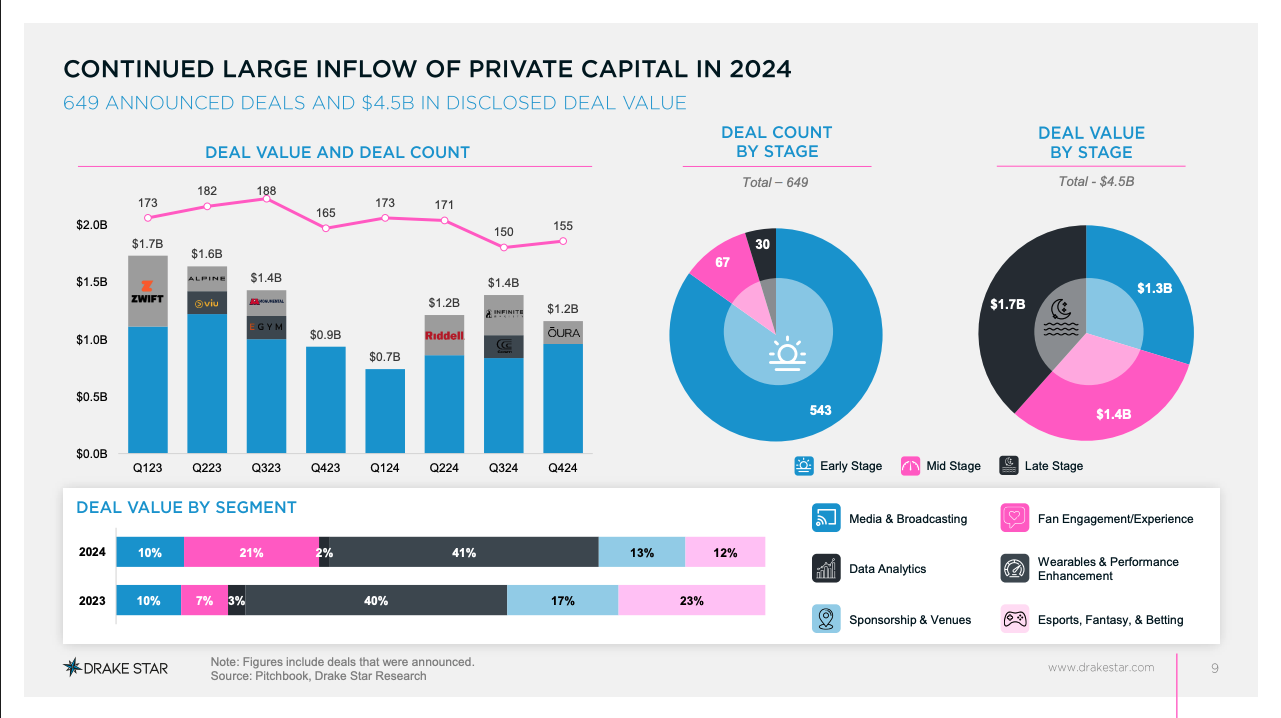

According to Drake Star’s Global Sports Tech Report 2024, the Sports M&A in the space remains strong despite broader macroeconomic headwinds. Sports assets are increasingly viewed as uncorrelated, cash-generating, and culturally durable investments.

The most sophisticated investors are no longer just chasing team equity. They're constructing diversified exposure across the entire value chain—just as they would with a traditional alternatives portfolio.

From Passion Plays to Portfolio Engines

So what changed?

Three forces are converging to reshape how sports is viewed as an asset class:

Institutional Capital Inflows: Sovereign wealth funds, endowments, and family offices are allocating to sports assets with increasing frequency. In 2023, over 60% of all global sports M&A transactions were led by North American investors, many pursuing minority stakes in teams, media rights, or infrastructure ventures.

Structural Innovation: Access is no longer limited to ultra-high-net-worth individuals writing eight-figure checks. Interval funds, thematic indexes, and evergreen structures are making professionally managed exposure to sports possible at a broader scale—often without lockups or carried interest.

Performance Characteristics: Sports assets offer a blend of contractual revenue (media deals, naming rights), inflation-resistant cash flows (ticketing, F&B, sponsorships), and scarcity value. They also carry emotional resonance, driving higher brand loyalty and cultural embeddedness than traditional real assets.

The Rise of the Portfolio Approach

Institutional investors aren’t just making isolated bets—they’re building portfolios that span multiple leagues, asset types, and geographies. This trend mirrors the evolution of real estate and infrastructure into institutional-grade allocations over the last 20 years.

Examples of this shift include:

Private equity firms acquiring stakes in multiple teams across leagues

Funds of funds targeting rights-based assets, such as media or ticketing platforms

Family offices allocating to mixed portfolios that include teams, health tech, and sports facilities

This strategy offers diversified exposure to sports while mitigating concentration risk and capitalizing on global tailwinds—including the expansion of women’s sports, the globalization of leagues, and the emergence of technology infrastructure.

Why Now?

The timing is not incidental.

Sports has matured as a business—global audiences, advanced analytics, dynamic revenue modeling. But the capital markets infrastructure surrounding it is only now catching up.

Just as REITs made real estate investable for the average portfolio, and BDCs brought structured exposure to credit, new fund structures are finally unlocking sports for non-billionaire investors.

Evergreen funds, index-driven strategies, and compliance-ready 40 Act vehicles like Champion Fund are enabling broader participation while maintaining institutional discipline.

Champion Fund’s Role in the Shift

Champion Fund was built to meet this moment.

We intend to construct the CVP Sports Index (SPMI) as a rules-based methodology to track and invest across the full stack of the private sports economy: from venture-backed tech to minority stakes in franchises, mid-cap private equity to real estate and hospitality platforms.

Our structure isn’t just about access—it’s about alignment:

No long-term lockups

No carried interest

Transparent, NAV-based pricing

Diversified, professionally managed exposure

In a space dominated by hype cycles and opaque ownership, Champion Fund seeks to deliver clarity, credibility, and cultural relevance—all in one vehicle.

Closing Thought

The question is no longer whether sports is an asset class.

The real question is whether your portfolio reflects that reality—and whether the tools you’re using to access it are designed for the future, not the past.